cctrickgame.ru

Recently Added

Start Stock Investing

This step-by-step guide is designed to help you make well-informed decisions and invest in the stock market with confidence – from the get-go. What could I invest in? · Decide on your goals, time horizon and liquidity needs · Determine your risk tolerance · Build a portfolio · Review your investments. How to start investing · Step 1: Figure out what you're investing for · Step 2: Choose an account type · Step 3: Open the account and put money in it · Step 4: Pick. Are you waiting to build up a large amount of money before you start investing in the stock market? It may not take as much money as you think! Using. The most common way to purchase individual stocks is through a brokerage account. A Financial Advisor can help you select stocks. Explore these ways to invest. Start investing—it's that easy! Resources To Help You Get Started. Practice Accounts. Try out our actual online investing site—not a demo. Practice placing. Here's how to start investing in stocks, with details on where to invest, how much and who can help. Only authorized participants (financial institutions who double as broker-dealers) own direct shares of these investment funds. But these authorized. Tips for beginners can help you start to fine-tune your investment strategies and take advantage of stock investment tools. This step-by-step guide is designed to help you make well-informed decisions and invest in the stock market with confidence – from the get-go. What could I invest in? · Decide on your goals, time horizon and liquidity needs · Determine your risk tolerance · Build a portfolio · Review your investments. How to start investing · Step 1: Figure out what you're investing for · Step 2: Choose an account type · Step 3: Open the account and put money in it · Step 4: Pick. Are you waiting to build up a large amount of money before you start investing in the stock market? It may not take as much money as you think! Using. The most common way to purchase individual stocks is through a brokerage account. A Financial Advisor can help you select stocks. Explore these ways to invest. Start investing—it's that easy! Resources To Help You Get Started. Practice Accounts. Try out our actual online investing site—not a demo. Practice placing. Here's how to start investing in stocks, with details on where to invest, how much and who can help. Only authorized participants (financial institutions who double as broker-dealers) own direct shares of these investment funds. But these authorized. Tips for beginners can help you start to fine-tune your investment strategies and take advantage of stock investment tools.

Step 1. What is investing? Investing means putting your money to work towards your personal financial goals and ambitions. · Step 2. What are your investment. Stock Market Investing for Beginners: Essentials to Start Investing Successfully: Tycho Press: Books - cctrickgame.ru Looking to start investing in stocks and shares? Revolut has you covered. Learn how to start investing with our quick courses and invest in global. Easy steps to start investing online · 1 · Open an account · 2 · Put money in · 3 · Pick an investment · 4 · Place your trade. How to Start Investing In the Stock Market: A Beginner's Guide · Step 1: Open a brokerage account · Step 2: Place your first trade · Step 3: Figure out your. 1. Open an equity savings account or a book-entry account. When opening the account, you will choose an investment service package that suits you. Your investment plan starts with a few key questions: Where are you now? And where do you want to be in the future? You can prepare to invest by reflecting on. To start investing in stocks, you would find a company that you like and think might grow in value and then purchase its stock through a brokerage account. This guide will provide you with a solid foundation to navigate the stock market with confidence. By the end of this lesson, you'll have a clear understanding. Steps to open an account · 1. Choose the type of investment account you want · 2. Compare fees, pricing schedules, and minimum balance requirements · 3. Review. Here's a step-by-step guide to investing money in the stock market to help ensure you're doing it the right way. Research a tax free account. (TFSA-IRA) Start with some solid dividends yields, bank stocks. Reinvest your quarterly dividends. Don't tell. Start your trading journey by bringing yourself up to speed on the financial markets. Then dive into company fundamentals, read charts, and watch the prices to. There are a few different ways you can start investing. Each involves sending the money you want to invest to a brokerage platform that can buy and sell the. 5 stock investment tips for beginners · 1. Use your personal brand knowledge · 2. Know the fundamentals · 3. Use technical indicators to spot trends · 4. Do the. Using investing apps like Robinhood and Webull is a good first step. Both brokerages offer commission-free trading on stocks, options, ETFs and crypto, with no. All investments involve some degree of risk. If you intend to purchase securities - such as stocks, bonds, or mutual funds - it's important that you understand. This guide will cover everything you need to know to start investing in the stock market. Before diving in, it's important to remember when you invest, your. You may make money buying and selling your shares of an ETF. Unlike a mutual fund, its value changes all day long while the stock exchange is open. Like mutual. Only focus on fundamental analysis and make your decision based on it. As you gain experience and learn which companies to invest in, you can also start.

How Much Does It Cost To Sell A Property

The full cost typically ranges between % and % of the sale price. The average is around %, so if you sell your home for $, you may pay a total of. Discover the comprehensive breakdown of expenses when selling a house in the UK. From estate agent fees to conveyancing costs, get a clear understanding of. Calculate your home's net proceeds with this home sale calculator and see how much you can profit when selling your home. Many housing markets across the U.S. are still seeing plenty of buyer interest, but properties aren't getting the regular bidding wars and sky-high sale prices. Costs of selling a home can include commissions and fees such as filing fees or notary fees, as well as potential taxes. Typical legal fees range from approximately €1, to €2, plus VAT. Building Energy Rating Certificate. In addition to this, you should factor in the cost. This can range from 0 to about 2% of the purchase price. That depends on the type of market you're in and how well your real estate agent negotiates for you. Property preparation - $+ · Property Styling - $ (average 4-bedroom home) · Photography - up to $ (dusk images) · Video & drone - $ (video) & $ . If you are going for sole agency, you should aim for a fee of % (this is 1% + VAT) – or even less for high value properties. But when you're looking for an. The full cost typically ranges between % and % of the sale price. The average is around %, so if you sell your home for $, you may pay a total of. Discover the comprehensive breakdown of expenses when selling a house in the UK. From estate agent fees to conveyancing costs, get a clear understanding of. Calculate your home's net proceeds with this home sale calculator and see how much you can profit when selling your home. Many housing markets across the U.S. are still seeing plenty of buyer interest, but properties aren't getting the regular bidding wars and sky-high sale prices. Costs of selling a home can include commissions and fees such as filing fees or notary fees, as well as potential taxes. Typical legal fees range from approximately €1, to €2, plus VAT. Building Energy Rating Certificate. In addition to this, you should factor in the cost. This can range from 0 to about 2% of the purchase price. That depends on the type of market you're in and how well your real estate agent negotiates for you. Property preparation - $+ · Property Styling - $ (average 4-bedroom home) · Photography - up to $ (dusk images) · Video & drone - $ (video) & $ . If you are going for sole agency, you should aim for a fee of % (this is 1% + VAT) – or even less for high value properties. But when you're looking for an.

How to sell traditionally. Learn more about the process of selling your house with a listing agent. If this is the best route for you, interview agents and. Costs that are associated with finalizing a property sale, known as closing costs, can vary in amount, ranging from 1% to 3% of the sale value, depending on the. The cost to sell a house typically involves various expenses such as real estate agent commissions (usually around % of the sale price). When you add on commissions, taxes, and fees, it can easily cost anywhere from 6% – 8% of the value of a home to sell a house. Despite the creation of Zillow. On average, it costs $ to sell a house in Washington. Use our cost-of-selling-a-house calculator to see how much you might pay when you sell your home. Sellers usually pay both their listing agent's commission and the buyer agent's commission charges, generally % of the home sale price per agent. Agent. What Is the Average Cost of Fixing Up a House to Sell It? The average homeowner can expect to spend around $30, to remodel their home. Preparation costs. Key takeaways · Coming in at around 1% to 3% of your home's sold price, estate agent fees will be the biggest cost you incur when selling a home · Next up it will. The fees of this process depend on the area and the complexity of the matter; many lawyers charge 1% of the sale price. The Tejada Solicitors Team assess their. Every estate agent will have their own set percentage, but the majority of high street estate agents will charge around 1 to 3 percent of the sale amount. In total, a buyer's closing fees often range from about 3% to 6% of the home's sale price. Are Closing Costs Tax Deductible? Most closing costs are not tax. This typically ranges from 1% to 3% of the sale price, plus VAT. Well, at Purplebricks, we do things a little differently — well, a lot differently. We'll sell. The hidden costs when selling a house · Bond cancellation. · Rates, taxes, and levies. · Compliance certificates. · Estate agent fees. · Repairs and maintenance. These fees usually sit around $ and $2, – so remember to factor this into your budget! Lender fees - finalising your mortgage. If you have a mortgage on. Legal fees are typically ££1, including VAT at 20%. They will also do local searches, which will cost you ££, to check whether there are any local. Commission – the agent receives a percentage of the sale price of the home – usually between 1 and 3 per cent. The rate an agent charges can depend on a number. This typically ranges from 1% to 3% of the sale price, plus VAT. Well, at Purplebricks, we do things a little differently — well, a lot differently. We'll sell. Understand the fee structure: – Traditional auctions typically charge the seller a commission (usually % of the sale price). – MMoA often charges the buyer. In general, it will cost around 10% of the sale price to sell your property, which includes agent's fees, advertising costs and legal fees. However, this is. Reallymoving found, on average, a seller was charged % of the sale price. On a lower-value property, an agent might charge a fixed fee. You should double-.

Employee Savings Plan Vs 401k

The Thrift Savings Plan (TSP) is a defined contribution retirement savings benefits that many private corporations offer their employees under (k) plans. An IRA lets you save for retirement outside of work. It generally provides more control and more investment selection. · A (k) is a retirement savings program. A profit sharing plan or stock bonus plan may include a (k) plan. A (k) Plan is a defined contribution plan that is a cash or deferred arrangement. CalSavers is California's new retirement savings program designed to give Californians an easy way to save for retirement. Visit our website today to learn. FERS is a retirement plan that provides benefits from three different sources: a Basic Benefit Plan, Social Security and the Thrift Savings Plan (TSP). A (k) is a retirement savings plan that lets you invest a portion of each paycheck before taxes are deducted depending on the type of contributions made. Unlike a standard (k) plan, the employer must make: (1) a matching contribution up to 3% of each employee's pay, or (2) a non-elective contribution of 2% of. A pension plan is funded and controlled by the employer, while a (k) is primarily funded by the employee, who may choose from a list of offerings, how the. Review retirement plans, including (k) Plans, the Savings Incentive Match Plans for Employees (SIMPLE IRA Plans) and Simple Employee Pension Plans (SEP). The Thrift Savings Plan (TSP) is a defined contribution retirement savings benefits that many private corporations offer their employees under (k) plans. An IRA lets you save for retirement outside of work. It generally provides more control and more investment selection. · A (k) is a retirement savings program. A profit sharing plan or stock bonus plan may include a (k) plan. A (k) Plan is a defined contribution plan that is a cash or deferred arrangement. CalSavers is California's new retirement savings program designed to give Californians an easy way to save for retirement. Visit our website today to learn. FERS is a retirement plan that provides benefits from three different sources: a Basic Benefit Plan, Social Security and the Thrift Savings Plan (TSP). A (k) is a retirement savings plan that lets you invest a portion of each paycheck before taxes are deducted depending on the type of contributions made. Unlike a standard (k) plan, the employer must make: (1) a matching contribution up to 3% of each employee's pay, or (2) a non-elective contribution of 2% of. A pension plan is funded and controlled by the employer, while a (k) is primarily funded by the employee, who may choose from a list of offerings, how the. Review retirement plans, including (k) Plans, the Savings Incentive Match Plans for Employees (SIMPLE IRA Plans) and Simple Employee Pension Plans (SEP).

The (k), the (b) and the plans are similar — your employer offers the one designed for your type of organization. The Defined Contribution Plan is defined under IRS codes (b), the IRS rules governing the Individual Contribution, and (a), the IRS rules governing the. Employers have the option to contribute to their employees' plans, thereby maximizing the full savings potential. How do k plans work? Employees who are. The voluntary defined contribution plans include the (k) and (b) Plans. All employees are eligible to participate in the City's (k) plan and all. (k) plans and (b) plans are tax-advantaged, meaning workers can preserve more of their investment growth for retirement rather than losing some to taxes. You have a choice of contributing pre-tax and after-tax Roth dollars to the Plans. Pre-tax contributions come out of your paycheck before your income is taxed. Having a pension means you may not need to save as much as someone relying solely on (k) investments for their retirement income. If you're just starting out. A (k) plan for a self-employed individual with no employees other than a spouse. Learn more. piggy bank icon. SEP IRA. Easy-to. DEFER” is the name of the voluntary retirement system (b, b and a savings plans) available to most State of Delaware employees including employees. With a Roth (k) an employee contributes after-tax dollars and gains are not taxed as long as they are withdrawn after age 59 1/2. Pros. A (k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection (k) of the US Internal Revenue. Those funds then grow tax-free until employees retire and begin to make withdrawals. At that time, the funds are taxed as ordinary income. In both a (a) and. (k) plans are primarily for employees of public corporations and tax This makes your retirement savings plan essential if you want to maintain. Faculty and Professional & Administrative (P&A) employees are invested in a defined contribution plan known as a (a) plan administered by Fidelity. The earnings associated with traditional after-tax contributions, however, will be taxable when distributed. Roth (k) contributions are like traditional. Similar to a (k) in its purpose, a (b) plan is designed to help you save for retirement through tax-deferred employee contributions. The benefit of a Employers with one or more employees must participate in CalSavers if they do not already have a workplace retirement plan. The following deadlines to register. The primary difference between a (k) and an IRA is that an employer offers a participant a (k), whereas an individual opens an individual retirement. A (k) is an employer-sponsored retirement account that allows an employee to divert a percentage of his or her salary—either pre- or post-tax—to the account. The earnings associated with traditional after-tax contributions, however, will be taxable when distributed. Roth (k) contributions are like traditional.

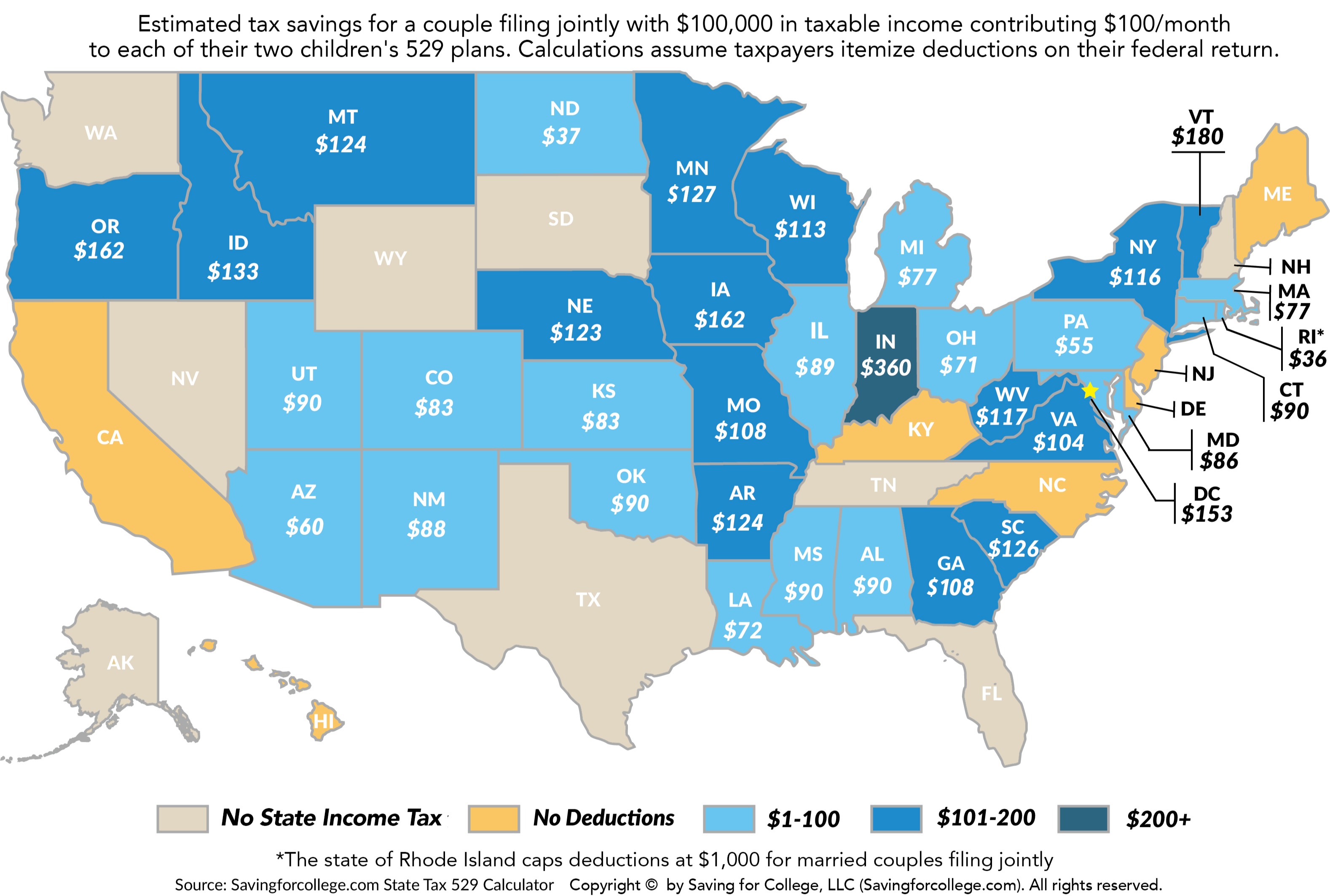

Do I Have To Pay Taxes On 529 Distributions

In most cases, the “earnings” portion of the withdrawal will be taxable as ordinary income and subject to a 10% federal income tax penalty. Additionally, non-. Qualified distributions are tax-free. Note that this assumes that you haven't also used a tax-free scholarship to pay for the expenses and won't. The big advantage of plans is that qualified withdrawals are always federal-income-tax-free—and usually state-income-tax-free too. Amounts transferred from another college savings plan are not eligible for the Minnesota income tax deduction or tax credit. Do I have to use my account at. Tax-Free Withdrawals — No income tax is paid on the growth of your account when withdrawals are used for qualified expenses. State Tax Deduction — Deduct. If you simply withdraw the money from your account for any non-qualified purpose, you'll have to pay federal income taxes as well as a 10% penalty on the. You'll have to pay income tax and a withdrawal penalty of 10% on the earnings portion. plan withdrawal penalty. The earnings portion of a non. There will be a 10% penalty on the account earnings of the amount withdrawn, and the earnings of the amount withdrawn will be taxed at the owner's rate of. Determine if any of the distribution is taxable? • Gross distribution is at least the same amount or less than the total Adjusted qualified expenses (defined in. In most cases, the “earnings” portion of the withdrawal will be taxable as ordinary income and subject to a 10% federal income tax penalty. Additionally, non-. Qualified distributions are tax-free. Note that this assumes that you haven't also used a tax-free scholarship to pay for the expenses and won't. The big advantage of plans is that qualified withdrawals are always federal-income-tax-free—and usually state-income-tax-free too. Amounts transferred from another college savings plan are not eligible for the Minnesota income tax deduction or tax credit. Do I have to use my account at. Tax-Free Withdrawals — No income tax is paid on the growth of your account when withdrawals are used for qualified expenses. State Tax Deduction — Deduct. If you simply withdraw the money from your account for any non-qualified purpose, you'll have to pay federal income taxes as well as a 10% penalty on the. You'll have to pay income tax and a withdrawal penalty of 10% on the earnings portion. plan withdrawal penalty. The earnings portion of a non. There will be a 10% penalty on the account earnings of the amount withdrawn, and the earnings of the amount withdrawn will be taxed at the owner's rate of. Determine if any of the distribution is taxable? • Gross distribution is at least the same amount or less than the total Adjusted qualified expenses (defined in.

Distributions from a plan that are used for qualified education expenses are not subject to federal income tax. In that case, you don't need to report anything on your taxes. But, if you take a distribution and use it for an unqualified expense, it counts as a taxable. Amounts transferred from another college savings plan are not eligible for the Michigan income tax deduction. Do I have to use my account at a Michigan. If you are making a withdrawal to cover a qualified education expense for the beneficiary, the withdrawal is not subject to federal or state income tax. plan distributions used to pay for non-qualified expenses are subject to income tax and a 10% penalty on the earnings portion of the withdrawal. Distributions from an IRC Section College Career and Savings Program Account not used for qualified educational expenses are taxable and reportable as. this rule, meaning taxpayers who use a distribution to pay for school tuition are required to add plan contributions, including income tax deductions. How do I determine if my IRA withdrawals are subject to PA income tax? Distributions from an IRA are not taxable if the payments are: Received, including lump. The earnings portion of money withdrawn from a plan that is not spent on eligible expenses will be subject to income tax, an additional 10% federal tax. If funds are withdrawn for a purpose other than qualified higher education expenses, the earnings portion of the withdrawal is subject to federal and state. However, withdrawals of the account's earnings are subject to both taxes and a 10% penalty unless you use them for qualified education expenses, such as tuition. The earnings portion of non-qualified withdrawals is considered taxable income and could incur an extra 10% penalty. Think back to the day you opened your. It's not required to report withdrawals used for qualified higher education expenses on your federal tax return. Each year in which a withdrawal is made, an IRS. Withdrawals for non-qualified expenses– including transportation, cell phones, and fees for sports or clubs – are subject to tax, plus a 10% penalty, so make. In the event that the Designated Beneficiary receives a scholarship for Qualified Higher Education Expenses, you can request a federal income tax penalty-free. The earnings portion of the non-qualified withdrawal is subject to federal and state income taxes and will be subject to a 10% federal penalty tax. Kansas. The earnings portion of a withdrawal for non-qualified expenses is taxed as ordinary income and assessed an additional 10% penalty tax. So, should you find it. The money you earn in a plan is not subject to federal or state income taxes, as long as it remains in the plan. This can help your account grow faster. Do I pay taxes on my withdrawals? Federal taxes. You don't have to pay federal income taxes on distributions from your account if the funds are used for. If funds are withdrawn for a purpose other than qualified higher education expenses, the earnings portion of the withdrawal is subject to federal and state.

Dos A Tron

Country Line › Dvds Y Discos Blu-ray › Tron: The Original Classic (Combo de dos discos Blu-ray/DVD). Siempre respondemos dentro de las horas. cctrickgame.ru: [email protected] - cctrickgame.ru PHV. Crédit photos: DOS. A. TRON - Studio C. Prigent - P. Loubet. The venturi principle consists of. The Dosatron direct injection kit is designed to be a simple cost effective way to apply fungicide and insecticide in-furrow with the seed. BabyTron & BLP Kosher. The Adventures of Tron & Kosher. with Trapland Pat & Nasaan. Buy Tickets Jack Daniel's Club No. 7 Upgrade. Price $ ADV / $35 DOS GA. Safety agency conditions of acceptability require module input fusing. The VI-x7x, VI-x6x and VI-x5x require the use of a Buss PC-Tron fuse or other DC-rated. Get more information for Hockey Tron in Vista, CA. See reviews, map, get the address, and find directions. TRON: Light Cycles is a famous and most played DOS game that now is available to play in browser. With virtual mobile controls you also can play in TRON. ©DOSATRON INTERNATIONAL S.A.S. Crédit photos: DOS. A. TRON - Studio C. Prigent. REF. DOSAGE. PRESSURE. EXTERNAL ADJUSTMENT. D 3 RE *. - %. The dose of concentrate will be directly proportional to the volume of water entering the DOSA. TRON, regardless of variations in flow or pressure which may. Country Line › Dvds Y Discos Blu-ray › Tron: The Original Classic (Combo de dos discos Blu-ray/DVD). Siempre respondemos dentro de las horas. cctrickgame.ru: [email protected] - cctrickgame.ru PHV. Crédit photos: DOS. A. TRON - Studio C. Prigent - P. Loubet. The venturi principle consists of. The Dosatron direct injection kit is designed to be a simple cost effective way to apply fungicide and insecticide in-furrow with the seed. BabyTron & BLP Kosher. The Adventures of Tron & Kosher. with Trapland Pat & Nasaan. Buy Tickets Jack Daniel's Club No. 7 Upgrade. Price $ ADV / $35 DOS GA. Safety agency conditions of acceptability require module input fusing. The VI-x7x, VI-x6x and VI-x5x require the use of a Buss PC-Tron fuse or other DC-rated. Get more information for Hockey Tron in Vista, CA. See reviews, map, get the address, and find directions. TRON: Light Cycles is a famous and most played DOS game that now is available to play in browser. With virtual mobile controls you also can play in TRON. ©DOSATRON INTERNATIONAL S.A.S. Crédit photos: DOS. A. TRON - Studio C. Prigent. REF. DOSAGE. PRESSURE. EXTERNAL ADJUSTMENT. D 3 RE *. - %. The dose of concentrate will be directly proportional to the volume of water entering the DOSA. TRON, regardless of variations in flow or pressure which may.

Tron is a video game published in on DOS by Xerox. It's a racing / driving game, set in a sci-fi / futuristic theme. © DOS. A. TRON INTERN. A. TIONA. L. S.A.S. D3 5 - 25%//D1. 2 m³/h - 5 - 25%. 9 GPM - - 7 - 57 psi. - 4 bar. Page 2. C. M. Contact Info | HockeyTron | | email: [email protected] | Monday - Friday A.M. - P.M. PST | Dos Aarons Way #C Vista. Look how smooth our Tron's passive ability is displayed. When enemy gets hit, they cannot hide from Tron - Passive: Temporarily highlight. The Dosatron® D14MZ2 medicator is a versatile unit capable of delivering up to 14 gallons per minute (GPM), perfect for the application needs of larger poultry. PC/ 2-Slot PCMCIA Module w DOS/Win31/Win95,G (PCME). by L-Tron Corporation. Lehigh Crossing Suite 6. Victor, NY Phone. Neotron - The Embedded Rust Home Computer Platform PC-DOS made use of BIOS APIs, but often games would bypass both MS-DOS and the BIOS and access hardware. for a DOS game from 80ss Hi retro gamers:). I am [DOS][s] looking for a game title (maze, tron?inspired. Crédit photos: DOS. A. TRON - Studio C. Prigent. Partially unscrew the black nut. Turn the dosing stem. Put the chosen rate on the black mark of the transpa. - 1 Compact Oosatron. - 1 wall bracket. - 1 The dose of concentrate will be directly proportional to the volume of water entering the Dosatron, regard-. Boxtron. Build Status Language grade: Python Luxtorpeda project Discord. Steam Play compatibility tool to run DOS games using native Linux DOSBox. This is a. tron, widely familiar from the memorable decals on the Audi e-tron – each new model also opens a new chapter. dos Santos remarks. “At Audi, technology. Mixtron Water Powered Dosing pumps require ZERO power to run. They simply dose product at a rate proportional to the water flow rate through the pump. New and used Audi A3 Sportback e-tron for sale in São José dos Campos on Facebook Marketplace. Find great deals and sell your items for free. Tron is the CEO of a large tech conglomerate. His father's mysterious death awakened Tron, leading him to investigate by infiltrating the DOS corporation. It was used primarily for debugging line-numbered BASIC GOTO and GOSUB statements. In text-mode environments such as the TRS or DOS, it would print the. Dos Gatos July 4 Celebration. Fireworks, Extended Happy Hour, & More. Join Resorts World Catskills. Audi E-Tron Drawing. Saturday, September The brand with the four rings has already presented more than 20 vehicles featuring this special exterior, all designed by Marco dos Santos, who is responsible. Hockey Tron. (27 reviews). $$ModerateHockey Equipment Dos Aarons Way. Ste A. Vista, CA Directions. () Call Now. Focus Tron's strategies keep the UnthinkaBot Brain Eater at bay 10 DOs and DON'Ts for Teaching Superflex. 10 DOs and DON'Ts for Teaching.

Stock Market Widget For Website

Looking to infuse your website with real-time financial insights? Our Market Widget is your answer. Seamlessly embed interactive financial charts and quotes. The scrolling Live Quotes web widgets offers a compact way to display real-time tickers for numerous Forex and CFD market instruments. Choose the best Stock market widget to create charts, add financial data to your website in 2 minutes. Free and fast! Customisable market widgets with real-time, interactive financial quotes for your website. Just copy-paste a code from the cTrader Web platform. Stock Market Prices and News Widget for Webmasters. Get free real time quotes on your website or blog, or wordpress plug in, including our news headlines on. I found this pretty cool and thought I would share. I see many posts/templates about budgeting, tracking etc. Widgets can be created here. Maximize your returns with best stock widgets from StockTargetAdvisor! Our financial widgets help to improve your investment decisions. Use Now! Add widgets to your home screen and effortlessly monitor your favorite stocks and cryptocurrencies in real-time! Access a wide range of stock exchanges. Chart Widget. Display your favorite stock's latest news, price, key metrics, and filings with our customizable chart widget. Get Widget. Ticker Hover. TSLA. Looking to infuse your website with real-time financial insights? Our Market Widget is your answer. Seamlessly embed interactive financial charts and quotes. The scrolling Live Quotes web widgets offers a compact way to display real-time tickers for numerous Forex and CFD market instruments. Choose the best Stock market widget to create charts, add financial data to your website in 2 minutes. Free and fast! Customisable market widgets with real-time, interactive financial quotes for your website. Just copy-paste a code from the cTrader Web platform. Stock Market Prices and News Widget for Webmasters. Get free real time quotes on your website or blog, or wordpress plug in, including our news headlines on. I found this pretty cool and thought I would share. I see many posts/templates about budgeting, tracking etc. Widgets can be created here. Maximize your returns with best stock widgets from StockTargetAdvisor! Our financial widgets help to improve your investment decisions. Use Now! Add widgets to your home screen and effortlessly monitor your favorite stocks and cryptocurrencies in real-time! Access a wide range of stock exchanges. Chart Widget. Display your favorite stock's latest news, price, key metrics, and filings with our customizable chart widget. Get Widget. Ticker Hover. TSLA.

Feature-rich financial widgets Stacked list with quotes that can be expanded to view more details. Call-to-action link or button with embedded market data. Get a glimpse of our future Squarespace plugins and widgets. See all the features of Squarespace Stocks plugin you can add to website. A simple and easy configurable plugin for WordPress that allows you to insert stock ticker with stock price information to posts, pages, widgets or even to. Embed widgets in your website or blog. Stock market quotes, Forex, Bitcoin, Index and Futures data in the functional HTML5 widgets by SoftCapital. Embed free widgets in your website or blog. Stock market quotes, Forex, Bitcoin, Index and Futures data in the functional HTML5 widgets by Finlogix. Add powerful stock market tools to your website and app. Embed widgets for SWOT, Stock Scores, and Stock Checklists. Copy and paste the line of code provided. Widget: Light Color Enter the below code in your website to get light widget cctrickgame.ru is for Stock / Commodity / Currency / Forex / Crypto Market. A powerful widget for real-time and historical price analysis. Compare symbols, draw trend lines, perform technical analysis and customize in a few clicks. A simple and easy configurable plugin for WordPress that allows you to insert stock ticker with stock price information to posts, pages, widgets or even to. Tired of opening your browser every time you want to check your portfolio? Stock Desktop Widget is the solution to your problem. Stock charts on your. Stock and Forex financial widgets for websites with pre-integrated data feeds! Get customizable UI and market data in minutes with DXCharts. An advanced stock market widget brought to you by TradingView. A fully customizable widget for the financial websites and blogs that comes at no cost. Ticker tape, Forex matrix, News feed, Charts or any other stock market widgets. Embed in your website our HTML5 widgets in few clicks, just like a YouTube. The Customizable HTML5 charting widget can be easily uploaded to your website. In order to embed the widget on your site, set the desired chart size and time. Features: • Stock charts from Nasdaq, NYSE, Euronext, and many more for free. Resize and place your widgets where you want, on any monitor. Change the font. This classic stock market widget provides a simple, yet stylish and practical way to showcase symbol data. Converter Widget. Our converter widget has been. Macroaxis financial widgets, such as Stock Ticker, are portable, reusable, and highly encapsulated Web components that can be installed within any separate HTML. Stock Market Prices and News Widget for Webmasters. Get free real time quotes on your website or blog, or wordpress plug in, including our news headlines on. You can find a list of all the widgets on TradingView. In this example, we'll embed Mini Chart Widget as an example. Once you've selected a widget, you will. Stocks Widget is a home screen widget that displays stock price quotes from your portfolio. Features: ☆ Completely resizable, it will fit the number columns.

Cost Of Cfar Travel Insurance

A "Cancel for Any Reason" policy is an option for broader coverage but reimbursement is usually for less than the full cost of the trip. Travel medical and. The best CFAR plans will reimburse up to 75% of trip costs (maximum of $7,) but allow travelers to cancel for any reason. CFAR coverage details are. The best CFAR option is with the Gold plan, whose CFAR benefit will let you get back up to 75% of the full cost of prepaid travel arrangements if you need to. Cancel For Any Reason (CFAR)*. May provide reimbursement when forced to cancel your trip For Any Reason (up to 75% of non-refundable Trip Cost). Cancel For Any Reason (CFAR) policies. These policies are more expensive and typically only reimburse you a percentage of your travel costs. The reason for. Purchase within 15 days of initial trip deposit. Insure % of pre-paid trip costs, 75%. How is CFAR Different from trip cancellation insurance? While. How much does CFAR coverage typically cost? Travel insurance with “cancel for any reason” coverage costs an average of $ per trip, according to our analysis. CFAR coverage adds 50% to the cost of your base travel insurance price and travel insurance typically costs between 5%% of your total trip cost. Let's. Travelers who are unable to or simply no longer want to take a trip may be able to get up to 75% of their trip costs back with CFAR, even if they have to cancel. A "Cancel for Any Reason" policy is an option for broader coverage but reimbursement is usually for less than the full cost of the trip. Travel medical and. The best CFAR plans will reimburse up to 75% of trip costs (maximum of $7,) but allow travelers to cancel for any reason. CFAR coverage details are. The best CFAR option is with the Gold plan, whose CFAR benefit will let you get back up to 75% of the full cost of prepaid travel arrangements if you need to. Cancel For Any Reason (CFAR)*. May provide reimbursement when forced to cancel your trip For Any Reason (up to 75% of non-refundable Trip Cost). Cancel For Any Reason (CFAR) policies. These policies are more expensive and typically only reimburse you a percentage of your travel costs. The reason for. Purchase within 15 days of initial trip deposit. Insure % of pre-paid trip costs, 75%. How is CFAR Different from trip cancellation insurance? While. How much does CFAR coverage typically cost? Travel insurance with “cancel for any reason” coverage costs an average of $ per trip, according to our analysis. CFAR coverage adds 50% to the cost of your base travel insurance price and travel insurance typically costs between 5%% of your total trip cost. Let's. Travelers who are unable to or simply no longer want to take a trip may be able to get up to 75% of their trip costs back with CFAR, even if they have to cancel.

To put this in dollar figures: Standard travel insurance for trip cancellation/interruption and medical expenses on a $20, trip may cost $1,; adding CFAR. How Much Does Travel Insurance Cost? Travel insurance costs range from 3% to 14 % of a trip's total value, according to quotes gathered by our research team. * Maximum Trip Cost is $, * Maximum Length of Trip is ninety (90) days. *Cancellation with the travel provider must be made 48 hours or more before the. * Maximum Trip Cost is $, * Maximum Length of Trip is ninety (90) days. *Cancellation with the travel provider must be made 48 hours or more before the. CFAR may reimburse you for 50% to 75% of prepaid nonrefundable trip costs, depending on the plan you choose, when you cancel for a reason not covered by your. CFAR/IFAR typically reimburses at 75% of the total non-refundable cost and can be an additional purchase for a reason that is not listed in trip cancellation or. Cancel for Any Reason (CFAR) allows you to cancel your trip prior to departure for any reason not otherwise covered by the plan and be reimbursed up to a 75%. Trip Cancellation For Any Reason coverage (CFAR) will let you cancel a trip for whatever reason you want and collect money on a claim. If you purchase a basic travel insurance policy that includes trip cancellation coverage, you can expect to pay between 5% and 10% of your trip costs. For example, if a standard policy costs $, adding CFAR coverage could increase this cost to anywhere between $ and $ This price increase reflects the. Cancel For Any Reason (CFAR) coverage, which is bundled with Interruption for Any Reason (IFAR), comes at an additional cost to your travel protection plan. The Cancel For Any Reason add-on benefit cost is typically about % of your base premium. For example, If your trip plan premium is $ and you add the. Travelers who opt for CFAR will need to insure % of their pre-paid and non-refundable trip costs and buy it within a set amount of days from their initial. Adamski noted the maximum trip cost that can be covered with CFAR is $25, When you make subsequent nonrefundable payments toward your trip, you must add. CFAR provides partial reimbursement of the insured prepaid, non-refundable trip costs when you cancel your trip for a reason not listed on the plan. CFAR coverage refunds you between 50% to 75% of your total trip cost (minus eligible refunds). CFAR is only available as an add-on to a standard travel. CFAR is an optional add-on to our existing travel insurance plans. You can expect to pay about an additional 3% of your total trip cost to add on CFAR coverage. How does cancel for any reason travel insurance work? The cancel for insured trip costs (up to $7,). In order to be eligible for reimbursement. The CFAR coverage is purchased within 15 days of the initial trip deposit. The trip is cancelled more than 48 hours prior to scheduled departure. The full cost. With Seven Corners Trip Protection, protect the cost of your trip, medical expenses, and belongings. We also offer optional cancel-for-any-reason-coverage.

Can You Get Free Money From Cash App

There is no glitch and there never was. If there was, Cashapp would notice it and reverse any such glitch. No free lunch. They probably have you. Instantly earn 1% back in stock, crypto, or cash, every time you spend with your Cash card. And no need to lift a finger: we'll automatically reinvest them for. 1 Use a Referral Code · 2 Refer Friends · 3 Participate in Giveaways and Sweepstakes · 4 Use the CashApp Debit Card · 5 Waive ATM Fees · 6 Take Advantage of Cash. Trust me it's not God sending money that will be taken back. Cash app is run by Sutton bank. If you don't know what happens at a real bank when. In general, if something sounds too good to be true (like free money in exchange for small payment), it's likely a scam. Q: Will Cash App Support ask for. Add these money codes to pad your Cash App balance. Each one pays $5, though it's rumored that some users can receive up to $ 1. 4N23HKQ. 2. DQDVLXG. One of the easiest and most effective ways to earn free money on Cash App is by taking advantage of its referral program. Cash App provides a generous referral. It's % legal and it's dead simple to do. Use the Yotta debit card as the source of funds whenever you make a payment on Cash App. With the Yotta debit card. Hashtags such as #cashappgiveaway or #cashappfriday have been on the rise and are not part of our official partnerships. We will never ask you to send money. There is no glitch and there never was. If there was, Cashapp would notice it and reverse any such glitch. No free lunch. They probably have you. Instantly earn 1% back in stock, crypto, or cash, every time you spend with your Cash card. And no need to lift a finger: we'll automatically reinvest them for. 1 Use a Referral Code · 2 Refer Friends · 3 Participate in Giveaways and Sweepstakes · 4 Use the CashApp Debit Card · 5 Waive ATM Fees · 6 Take Advantage of Cash. Trust me it's not God sending money that will be taken back. Cash app is run by Sutton bank. If you don't know what happens at a real bank when. In general, if something sounds too good to be true (like free money in exchange for small payment), it's likely a scam. Q: Will Cash App Support ask for. Add these money codes to pad your Cash App balance. Each one pays $5, though it's rumored that some users can receive up to $ 1. 4N23HKQ. 2. DQDVLXG. One of the easiest and most effective ways to earn free money on Cash App is by taking advantage of its referral program. Cash App provides a generous referral. It's % legal and it's dead simple to do. Use the Yotta debit card as the source of funds whenever you make a payment on Cash App. With the Yotta debit card. Hashtags such as #cashappgiveaway or #cashappfriday have been on the rise and are not part of our official partnerships. We will never ask you to send money.

Cash App provides unlimited free withdrawals at in-network ATMs, as well as one instantly reimbursed out-of-network withdrawal per 31 days, for customers who. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. Cash App users can make easy local payments - but your Cash App account may not be the best choice if you need to send money internationally. That's because. Cash App (formerly Square Cash) is a mobile payment service available in the United States and the United Kingdom that allows users to transfer money to one. No, it is not possible to obtain free money on Cash App by sending funds to yourself across various accounts on different devices. Cash App does. The FreeMoney App offers users a unique opportunity to earn free money through various tasks and activities. Its user-friendly interface and straightforward. Cash App Support will never ask you to provide your sign-in code, PIN, Social Security Number (SSN), and will never require you to send a payment, make a. You and your friends can both get bonuses when they use your Cash App referral code to sign up for Cash App. For both of you to claim your referral bonus. Earn real money by completing simple tasks with the app. Easily make money by completing surveys, giving opinions, testing services,.. To earn money, you. Make Money: PayPal Cash Cash App for Paid Surveys & Rewards Apps. Did you know? Fact: Work tomorrow will be totally different from work today Future today. Yes and no. Here's a breakdown of why it's not entirely straightforward: Ways you CAN get some free money on Cash App: Referral Program: The. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. It's % legal and it's dead simple to do. Use the Yotta debit card as the source of funds whenever you make a payment on Cash App. With the Yotta debit card. Receive and send money for free with Cash App. Pay anyone in using a phone Send and receive stocks and bitcoin just like you would money. Brokerage. One of the easiest and most effective ways to earn free money on Cash App is by taking advantage of its referral program. Cash App provides a generous referral. Can You Make $2, Free Money on Cash App? No, the notion of making $2, in free money on Cash App without any catch is misleading. However. ATM withdrawals using this application are free and users can receive paychecks up to two days early. Cash App offers advanced security features, which allow. To make payments, you need the contact's phone number, QR code, or email, and can then either send or receive money, which is free of charge. Cash App is. Your money isn't FDIC insured, like it would be in your bank account. So, if you get scammed on Cash App, you have no protection or recourse to reclaim your. Cash App is the easiest way to send, spend, save, and invest your money. Here's how it works: When you have money in Cash App, you can: Let's get started.

Ca Refinance Mortgage Rates Today

Today's mortgage rates in Los Angeles, CA are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. Today's year fixed mortgage rates. % Rate. % APR. If you're looking to refinance your current loan, today's national year refinance interest rate is %, down 4 basis points from a week ago. In addition. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. Current 30 year-fixed mortgage refinance rates are averaging: %. Using our free interactive tool, compare today's mortgage rates in California across various loan types and mortgage lenders. Find the loan that fits your needs. Current California mortgage rates by loan type ; year fixed, %, % ; year fixed, %, % ; year fixed, %, % ; year ARM, %. The current average year fixed mortgage rate in California increased 3 basis points from % to %. California mortgage rates today are 6 basis points. Today's mortgage rates in Los Angeles, CA are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. Today's year fixed mortgage rates. % Rate. % APR. If you're looking to refinance your current loan, today's national year refinance interest rate is %, down 4 basis points from a week ago. In addition. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. Current 30 year-fixed mortgage refinance rates are averaging: %. Using our free interactive tool, compare today's mortgage rates in California across various loan types and mortgage lenders. Find the loan that fits your needs. Current California mortgage rates by loan type ; year fixed, %, % ; year fixed, %, % ; year fixed, %, % ; year ARM, %. The current average year fixed mortgage rate in California increased 3 basis points from % to %. California mortgage rates today are 6 basis points.

Mortgage rates today · yr fixed. Rate. %. APR. %. Points (cost). ($4,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. See what today's mortgage rates look like for your next home purchase or refinance. Simply use our mortgage-rate tool below to estimate and compare rates. Today. The average APR on the year fixed-rate jumbo mortgage is %. Last week. %. Mortgage Rate Trends. Qualified Mortgage Bond Program (QMB). All veterans and current members of the California National Guard or U.S. Military Reserves. Subject to income and. Compare refinance rates from lenders in California. Get free, customized refinance quotes in your area to find the lowest rates available. Refinance rates · yr fixed. Rate. %. APR. %. Points (cost). ($3,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. Current Refinance Rates - 30 Years California Lenders Under 7% 30 Year Fixed Rate ; Beeline Loans, Inc. Lender InfoNMLS ID: % APR, % Rate Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. An escrow (impound) account is required. The rate lock period is 60 days and the assumed credit score is At a % interest rate, the APR for this loan. Current Refinance Rates. The average APR for a year fixed refinance loan increased to % from % yesterday. This time last week, the Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Track live mortgage rates ; Top 5 Originators in California. %. Pennymac Home Loans. %. US Bank ; Originations by Property Type. %. Single Family. Below are today's purchase and refinance mortgage rates on our conventional, FHA and VA loan programs for homes in California. Today's competitive mortgage rates ; Rate % ; APR % ; Points ; Monthly Payment $1, Should I refinance my mortgage? ; Current loan balance ($) ; Annual interest rate (0% to 40%) ; Number of months remaining (1 to ) ; Current payment (optional). Today's Interest Rates ; CalHFA FHA · % ; CalPLUS FHA with 2% Zero Interest Program · % ; CalPLUS FHA with 3% Zero Interest Program · N/A ; CalHFA VA · %. For a year loan of $,, you would make payments of $ 1, at % APR, followed by payments based on the then-current variable rate. Loan. The following table shows current year Mountain View mortgage refinance rates. You can use the menus to select other loan durations, alter the loan amount. Today's year fixed refinance rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. California Mortgage Rates · Los Angeles mortgage rate trends · September 08, · % · % · % · Mortgage tools · Mortgage tips · Mortgage Rates by State.

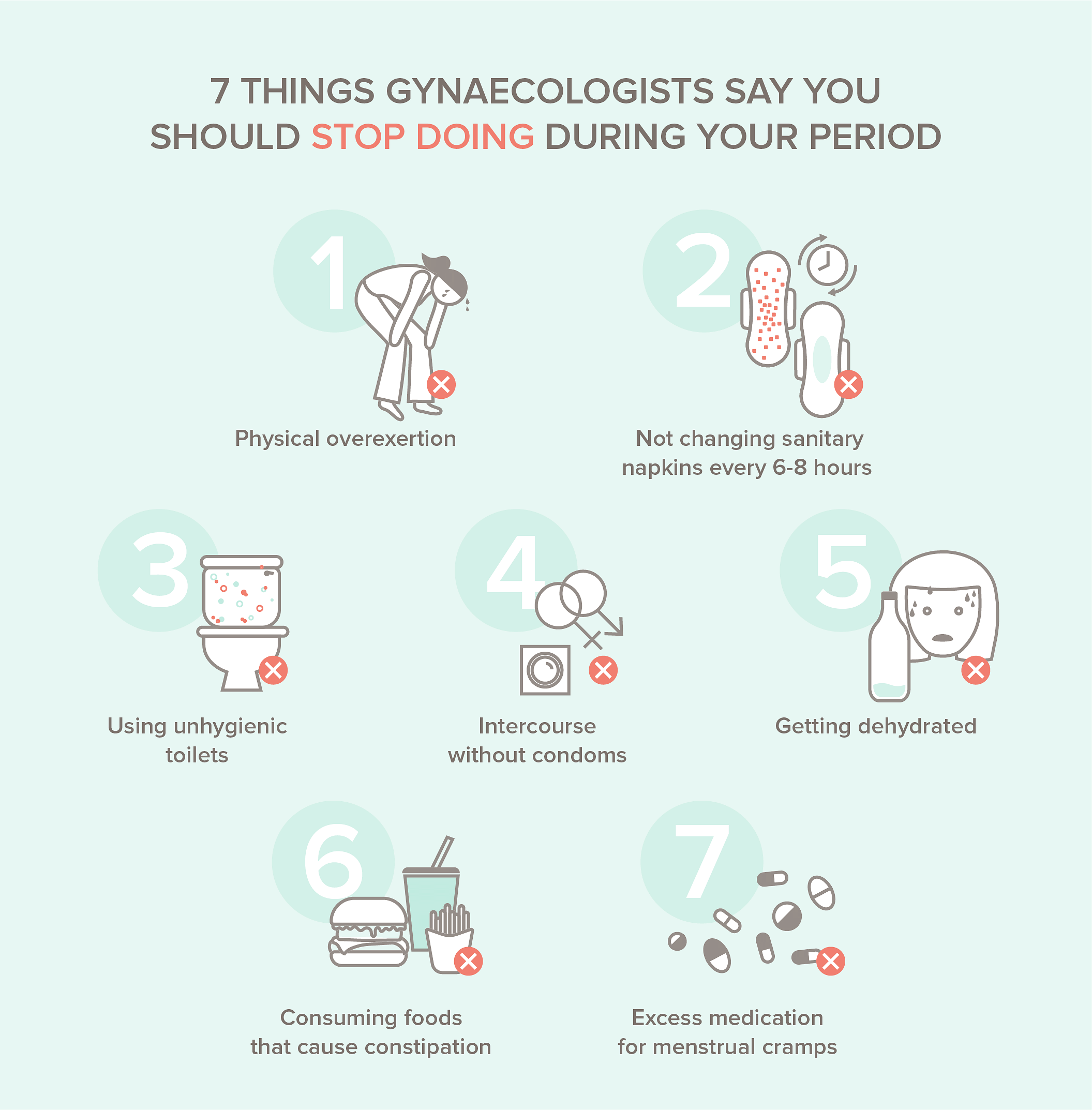

Will Douching Stop Period

Douching won't solve or prevent any of these and may well make them much worse. Your period or menopause can cause changes in vaginal odor. Your period is. A patient who has stopped her menses for 6 to 12 months, then Many patients will assume that the occurrence of any bleeding episode is a "period. It's fine to rinse the labia and opening to the vagina with fresh water every day or every few days, depending on how active you are. Douching is not good for the normal flora of the vagina and can cause overgrowths of bacteria and fungus. We reocommend you avoid douching entirely. Sexually. Changes in vaginal discharge can also occur due to: Using feminine hygiene sprays; Using certain types of soaps; Taking antibiotics; Douching. limit sources of irritation; reduce excess moisture and associated fungal growth; maintain an optimal balance of microorganisms inside the vagina ; not douching. You've probably come across all kinds of claims that doing this or taking that will stop your period on command. Using apple cider vinegar or gelatin are. There are no safe or even effective home remedies that can help to delay periods. Popular suggestions such as herbal concoctions, douching, or extreme dietary. How long does your menstrual period last? How long between each menstrual stop menstrual flow and reduce the size of fibroids. Tranexamic acid. Douching won't solve or prevent any of these and may well make them much worse. Your period or menopause can cause changes in vaginal odor. Your period is. A patient who has stopped her menses for 6 to 12 months, then Many patients will assume that the occurrence of any bleeding episode is a "period. It's fine to rinse the labia and opening to the vagina with fresh water every day or every few days, depending on how active you are. Douching is not good for the normal flora of the vagina and can cause overgrowths of bacteria and fungus. We reocommend you avoid douching entirely. Sexually. Changes in vaginal discharge can also occur due to: Using feminine hygiene sprays; Using certain types of soaps; Taking antibiotics; Douching. limit sources of irritation; reduce excess moisture and associated fungal growth; maintain an optimal balance of microorganisms inside the vagina ; not douching. You've probably come across all kinds of claims that doing this or taking that will stop your period on command. Using apple cider vinegar or gelatin are. There are no safe or even effective home remedies that can help to delay periods. Popular suggestions such as herbal concoctions, douching, or extreme dietary. How long does your menstrual period last? How long between each menstrual stop menstrual flow and reduce the size of fibroids. Tranexamic acid.

Washing inside the vagina (known as 'douching') is a really bad idea, even on your period. During your period, it's a good idea to avoid tight clothing. A member asked: Could douching stop your period? A doctor has provided 1 answer. A member asked: Does douching make ur period end faster? Avoid using vaginal hygiene products during menses – as these chemicals can The vagina is self-cleaning so avoid douching (washing the inside of your vagina). Use the douche and suppositories throughout one entire menstrual cycle. Be This will stop the itching and help draw out the infection. Use until. Years ago, women would do this after their period to clean themselves out. Women also used douching to prevent pregnancy. However, douching actually wipes. Eliminating vaginal odors; Washing away menstrual blood; Preventing sexually transmitted infections. Does douching actually work? All the available scientific. Do not douche unless your health care provider tells you to. These products do not prevent or treat infections. Instead, they can kill the good bacteria, change. Believe it or not, this is a common menstruation myth. Being submerged in water does not (entirely) stop you bleeding in the bath when on your period. Some. "PMS causes mostly mood symptoms, like irritability, anxiety, and fatigue. The hallmark of endometriosis is pain." MYTH: Endometriosis can be caused by douching. You can douche with tepid water once or twice a day if Most patients over 40 will stop having regular menstruation cycles while having chemotherapy. Women mistakenly believe it safely cleans the vagina and can prevent pregnancy, sexually transmitted infections, and vaginal odor. stop heavy menstrual. EVA INTIMA® POST-MEN STRUAL DOUCHE is designed to offer effective vaginal cleansing after the end of the period (menstruation). Douching can take place. Some women feel more comfortable if they douche at the conclusion of their menstrual period. This is not harmful as long as only warm water used, and you douche. Semen is alkaline (basic) and can also alter the pH of your vagina, so using this barrier method during intercourse can prevent an imbalance. Douching. Douching. You can start tracking your mucus the day after your period stops completely. Douching. Early menopause. Using hormonal birth control recently (including. Douching might make it seem like your period has stopped for a little while, because the blood will be very diluted. If your period is pretty much stopped, but. What can I do to reduce cramps? Why do I have problems with my bowels when I have my period? What are the causes of painful periods? What is normal. Some people clean their vagina after having sex to prevent pregnancy, but it won't work. If you decide to have sex, use reliable birth control instead. Oral contraceptives (birth control pills) can help regulate menstrual periods and reduce heavy bleeding. Douching is not recommended because it can. menstrual products and can be used to clean your menstrual disc. It is recommended to sterilize the menstrual disc at the beginning and end of each menstrual.

1 2 3 4 5